Contents:

In this blog, we’ll break down the key difference between comptroller and controller, explain the role of a CFO, and help you determine which roles are essential to your business’s finance team. The CFO uses their financial knowledge to forecast and strategize for the business’s future, promote growth, and advise stakeholders. They should be able to identify financial risks and implement plans to shelter the company from them. Whereas, CFO is a senior executive responsible for financial affairs, taking significant decisions relating to investment, making strategies and managing financial activities. CEO is the highest-ranking executive with the primary responsibilities of taking major corporate decisions, a medium of communication between corporate working and the board of directors. CFOs and controllers are both seasoned professionals, with backgrounds in accounting or finance.

One definition of an accountant is a professional who performs accounting functions such as audits or financial statement analysis who usually has a variety of administrative roles within a company’s operations. Accountants may perform financial functions related to the collection, accuracy, recording, analysis and presentation of a business, organization or company’s financial operations. Accountants can be employed with an accounting firm, a large company with an internal accounting department, or can set up an individual practice. Accounting, financial reporting, and financial planning are the backbone of any successful business. Small companies often handle their own bookkeeping in the early stages.

- These systems provide real-time visibility and efficient processing at all levels within the financial organization.

- Understand both roles, who they are, their responsibilities, and when to hire them to help you make an informed decision before setting up your finance leadership.

- The easiest place to start in a controller vs. CFO comparison is to give you a description of each role.

- Knowing when to hire a full-time CFO, fractional CFO, and controller is essential for growing your business.

- Financial controllers must also have several years of experience working in accounting or finance.

CFOs must also be able to effectively manage a team of financial professionals. A CFO is often seen as a key member of a company’s leadership team. Though the Chief Financial Officer and the financial controller work closely together, they have significantly different roles within a company.

What does a comptroller do?

For the most part, CFOs will spend their days staying up to date on the progress of current financial objectives. If business were a game of football, the controller would be the scorekeeper. Regardless of whether you are a CFO or Controller, you should strive to be the financial leader in your company. Download the free7 Habits of Highly Effective CFOs to find out how you can become a more valuable financial leader.

- In a smaller company, you may see a controller setting up the accounting infrastructure and performing the bookkeeping, while larger companies use controllers more in the role of oversight management.

- Controllers and CFOs are very involved in a business’s financial picture and planning.

- Many of the issues in this post are covered in the CFO Centre’s e-book “Financial Reporting,” which goes into detail about the insights that you can gain from a CFO’s strategic view of your company’s financials.

Controllers and owners alike can find themselves stretched too thin trying to track the company’s finances and make strategic moves to grow the business. If you lack the resources or don’t want to bring someone in-house, outsourced controller or CFO services can be an effective solution — either permanently or until you’re in a position to hire someone. You might also engage a CFO/ consultant on a short-term contract to help you target a strategic direction.

Company

This strategic leader works with financial reports but is more interested in analyzing financial data and growing a company’s profitability. You may need an in-house CFO at either a large public corporation or a small private company, and while the financial strategies may differ, the responsibilities are similar. This technical role can include managing accounts receivable, conducting operations oversight analysis, and creating and monitoring internal controls.

CFOs On the Move: Week Ending March 24 – CFO.com

CFOs On the Move: Week Ending March 24.

Posted: Fri, 24 Mar 2023 07:00:00 GMT [source]

It is the role of the controller to plan the finance activities of a company, set up internal controls, etc. Often holding a CPA, controllers are accounting experts whose skill set and knowledge base revolve primarily around GAAP, tax laws, and financial reporting. Compared to CAOs, controllers’ duties lie within a relatively narrow range. Similarly, CAOs are accounting experts, but the position demands versatility. A CAO may be found preparing an ESG report one week, assisting the CFO on budgeting the next week, and planning for an IPO the next.

Controller vs. Comptroller

Scalable solutions for reporting, transactions, month-end close, analysis, and more. Integrated cloud business software suite, including business accounting, ERP, CRM and ecommerce software. Innovative software to manage your accounting, people, payroll, payments, and more. Industry focus allows us to be experts in the accounting needs of the companies that operate within these industries. Working with internal and external auditors going over the financial records. Broad experience with the financial challenges from a multitude of different companies.

People in the News at Adaptive Biotechnologies, Biocartis, Sherlock … – GenomeWeb

People in the News at Adaptive Biotechnologies, Biocartis, Sherlock ….

Posted: Fri, 14 Apr 2023 15:09:34 GMT [source]

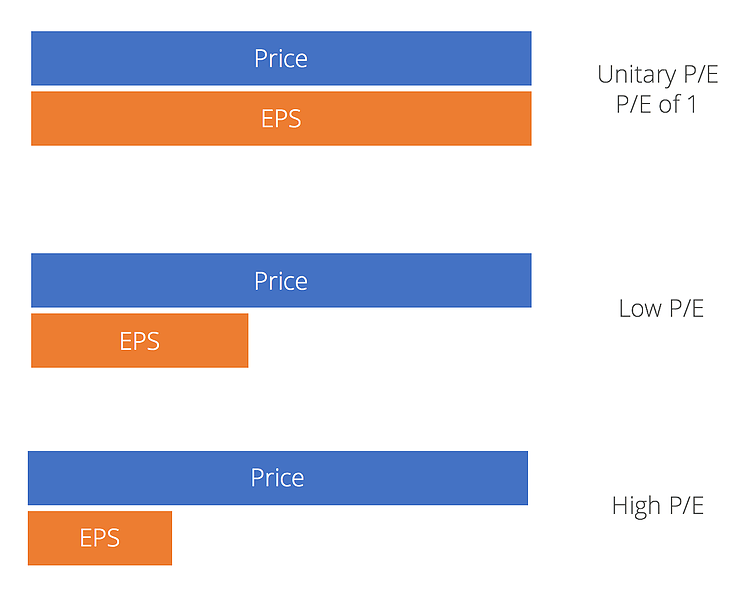

That’s one way to sum up the difference between the two positions. A comptroller or controller focuses on keeping the company’s accounts and preventing errors or fraud in money handling or bookkeeping. The vice president of finance, also known as a chief financial officer, looks at the bigger picture and pushes the company to be more efficient and profitable. The comptroller definition says the comptroller reports to the CFO.

Hire a superstar part-time CFO

In smaller companies, a controller might be the only financial manager in the company or, they might supervise a team of accountants. They manage their duties with help from a clerk, bookkeeper or administrative assistant. In general, a controller concentrates on accounting and compliance while a CFO focuses on the forward-looking strategy of the organization. The biggest difference between a controller and a CFO is that a controller manages and measures historical financials while a CFO strategizes and executes a forward-looking financial strategy. A controller’s main duties include organizing your existing books, keeping them in order, and providing timely and accurate financial reporting and analysis.

Within the business’ hierarchy, a CFO will usually report to the CEO and the board of directors while acting as the primary financial spokesman. A CFO may also spend time negotiating with lenders and other funding sources, and maintaining relationships with banks and sureties. In addition, he or she will help with the company’s technology purchasing decisions. A good CFO should be at the elbow of the CEO, ready to support and challenge them in leading the business.

The difference between a CFO and a controller

truckers bookkeeping service is the official abbreviation for Chief Finance Officer in a company and is usually ranked just below CEO . When a business sale, acquisition, or major investment is contemplated, one important step in the due diligence process is the generation of a Quality of Earnings report, sometimes abbreviated as QOE. Even though a company may have strong financial statements, those…

And at that stage, the https://1investing.in/ is far more concentrated on managing internal controls, report generation, and closing processes. The CFO is not just responsible for preparing financial statements — instead, the CFO analyses financial trends, identifying opportunities, reducing costs, as well as identifying threats to the company. Not only that, CFO ensures that all financial decisions are made well. CFO supervises diverse finance/accounts teams, as well as oversees the business’s overall performance. The CAO is the second-highest ranking finance professional in an organization, reporting to and working directly with the CFO. As the role of CFO has become more demanding, CAOs oversee the tactical and operational tasks that CFOs once dominated.

New-age SaaS finance controller is no longer just a backstage coordinator; they play a crucial role in managing a business’s revenue engine and growth. “The tone at the top plays a key role in ensuring how well the finance function influences other departments and processes,” – Mike Beach, CFO, Chargebee. We are here to help guide you through the outsourced accounting process and to answer any questions you may have. With decades of experience and hundreds of clients, Plumb is here to support you as you take your business to the next level. Please let us know if you’d like to schedule time for a free consultation.

Catalent Provides Business Update and Names Ricky Hopson as … – businesswire.com

Catalent Provides Business Update and Names Ricky Hopson as ….

Posted: Fri, 14 Apr 2023 11:30:00 GMT [source]

What are the signs that you may need more than what a controller mindset can provide? By comparison, the role of the CFO is to provide forward-looking financial management. It’s a proactive role since it is concerned with the company’s future financial success.